Maximum Epf Contribution By Employee Malaysia

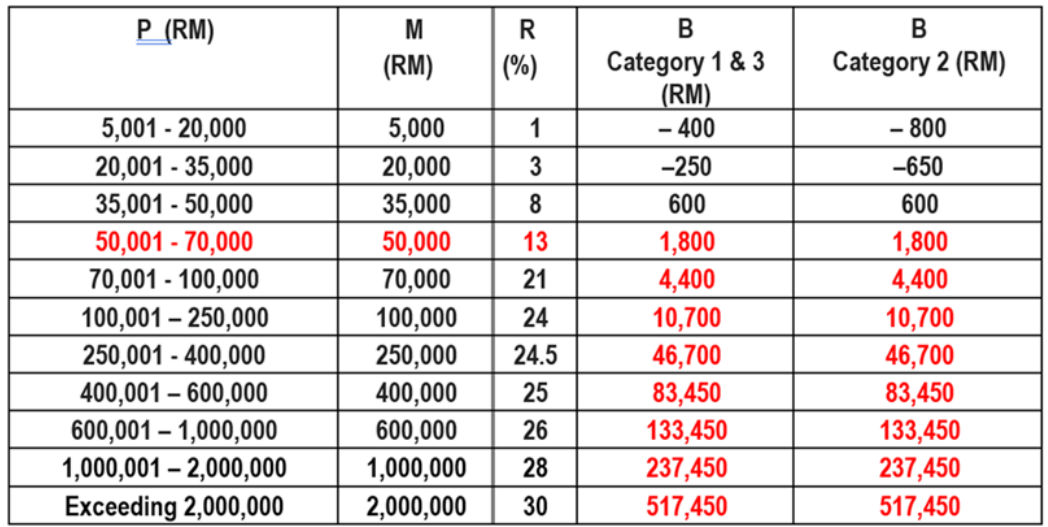

Tax relief deduction. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Epf Reduces The Statutory Contribution Limit To 9 For All Workers Varnam My

New Statutory Contribution Rate Of 2021 9 Or 11

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal Malaysia

The Employees Provident Fund said the governments move to extend the statutory contribution rate at 9 until mid-2022 should come as a.

Maximum epf contribution by employee malaysia. Are you currently employed and wondering if the contribution limit of RM60000 a year including the EPF contributions deducted from your salary. National Day Birthday of the Yang Dipertuan Agong Birthday of RulerFederal Territory Day Labour Day and Malaysia day in one calendar year and on any day declared as a public. The answer is No.

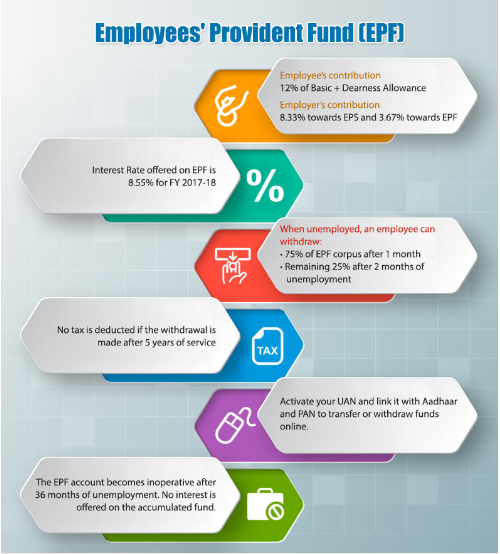

Changes for professional tax in Maharashtra for senior citizens. The contribution made towards the NPS scheme up to the maximum limit of Rs15 lakhs is eligible for tax exemption under Section 80C of the Income Tax Act. Reduction in Employees Provident Fund EPF contribution rate The employees portion of EPF contributions will be reduced from 11 to 9 for a period of 12 months from the beginning of January 2021.

Moreover the EPF scheme also helps the individual to fulfill their financial objectives of life and help them to deal with any type of emergencies. The employer makes a contribution to EIIS only for employees who are not eligible to be covered under the IPS with the amount restricted to a monthly maximum of MYR 4940. If the employee worked before in the current year.

We have a client with employees in Malaysia who we informed about the new EPF contribution rates. There are two schemes administered by SOCSO Act namely. The last rate that you opt for will be your new contribution rate and will remain as so until you andor your employer submits a cancellation notice.

Some of the salient features of the EPF Scheme are. Receive 5000 bonus reward points monthly. Employer is responsible of notifying IRBM that their employee is about to retire leave Malaysia permanently or employee is subjected to MTD scheme and the employer has not made any deduction.

Not exceeding eight hours in one day or 48 hours in one week. However the maximum contribution is based on wages of RM4000 per month Amendments with effective 1 Jun 2016. Because the rate was a reduction the employee had the option to maintain the previous 11 contribution rate to increase their retirement savings or to elect the new lower 9 rate.

The rate of contribution was progressively increased to 25 for both employers and employees in 1985. Additional Reward Points each for Contactless Purchases Online shopping spend and Groceries spend and 6000 Additional Reward Points for Overseas Transactions as defined in Clause 16 per Eligible Cardholder per Month Additional Reward Points Cap. At least 11 gazetted public holidays inclusive of five compulsory public holidays.

The sum is based on the employees monthly wages and is restricted to a maximum of MYR 6905 for the employer and MYR 1975 for the employee. Then indicate the employees details for the past month. The special incentive will be given from year 2018 until 2022.

As for the maximum contribution effective from January 2013 the maximum contribution for EPF Voluntary Contribution including EPF Self Contribution is capped at RM60000 per year. Finally list down the employees details for the current month. In this savings scheme the employee and employers make an equal contribution of 12 of the employees monthly salary towards the PF account.

Moreover in the National Pension Scheme the contribution made by the employer and the employee are. As a part of the Self-Reliant India Movement proposed by the government there will be reduction in the EPF contribution of the employer and the employee for three months. In Malaysia The Employees Provident Fund EPF was established in 1951 upon the Employees Provident Fund Ordinance 1951.

In contrast of the form CP22 CP22A is a cease of employment form. The employer or the employee or both may choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991. The employer contribution was cut to 10 during a recession in 1986.

The employer contribution rate was reverted to match the employee rate until the 19971998 Asian Financial Crisis and thereafter lowered to 10 for workers 55 years or younger. Earn annual EPF dividend on your retirement savings Receive additional special incentive of 15 subject to a maximum of RM250 annually for members aged below 55 years old. 1 Terms and Conditions for HSBC Platinum Credit Card Programme apply.

Employee Election of Reduced Contribution. SQL Payroll software ready with all malaysia government report EPF Borang A SOCSO Borang 2 SOCSO Borang 3 SOCSO Borang 8A EIS Borang 1 EIS Borang 1A EIS Borang 2 EIS Borang 2A EIS Lampiran 1 Income Tax CP39 CP39A Income Tax CP 39A Income Tax CP 22 Income Tax EA Form Income Tax EC Form Income Tax CP 8 CP 159 Income Tax e Data Praisi Income Tax CP 8D Borang E Income Tax. Apply for Visa Platinum Credit Card Online and earn 10x rewards points for online spends 5x rewards points on dining.

Maximum RM 4000 relief per year. The EPF rules were then amended to reflect the new guidelines whereby an individual who is a member of the Employees Provident Fund Organization EPFO would be allowed to withdraw an amount that is equivalent to three months of their basic and dearness allowance DA or be able to withdraw 75 of the credit balance in their account whichever is the lesser amount of the two. The EPF is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 provides retirement benefits for members through management of their savings in an efficient and reliable manner and that such contributions are payable to the employees in full on reaching the age of 55.

In a statement today the Employees Provident Fund EPF said the extension which can be opted out if members choose to will take effect from January 2022 wages February 2022 contribution. Employers are given 30 days before the employees date of cease of employment to notify IRBM. EPF CEO Datuk Seri Amir Hamzah Azizan said the extension of nine percent statutory contribution rate announced in the Budget 2022 should come as a relief for employees as it helps to increase employees take-home salary and ease financial hardship.

Employment Injury Scheme which provides social insurance coverage against workplace accidents occupational diseases and commuting accidents to and from place of work. In a statement today the Employees Provident Fund EPF said the extension which can be opted out if members choose to will take effect from January 2022 wages February 2022 contribution until June 2022 wages July 2022 contribution after which the minimum statutory contribution rate for employees returns to 11 per cent. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

The proposed changes are as follow-Effective from 1 January 2021. The EPF is intended to help employees from the private sector save a fraction of their salary in a lifetime banking scheme to be used primarily as a retirement fund but also in the event that the employee is temporarily or no longer fit to work. The Additional Reward Points are awarded up to a maximum of 3000.

For more information refer to SAP Note 2927722.

Just An Ordinary Girl Singapore Cpf Vs Malaysia Epf

Malaysia Payroll And Tax Activpayroll

Just An Ordinary Girl Singapore Cpf Vs Malaysia Epf

Malaysia Epf Calculator For Payroll System Smart Touch Technology

Making Voluntary Epf Contributions Mypf My

Epf Employee Contribution 11 Or 8 Henry Tan Your Finance Doctor

Kwsp Epf Voluntary Contribution I Saraan

Malaysia Nominal And Real Rates Of Dividend On Epf Balances 1961 1998 Download Table

0 Response to "Maximum Epf Contribution By Employee Malaysia"

Post a Comment